Mutual Funds:

What if you could invest your money and have someone else professionally manage it for you? Services like these do exist, but they come with a requirement of high amounts of capital or money to be invested. What if you could avail such a service, even with a small investment and get the advantage of professional money management? Well, this is possible by investing in mutual funds.

A mutual fund is essentially a common pool of money in which investors put in their contribution. This collective amount is then invested according to the investment objective of the fund. The money could be invested in stocks, bonds, money market instruments, gold and other similar assets. These funds are operated by money managers or fund managers, who by investing in line with the specified investment objective attempt to create growth or appreciation of the amount for investors.

For example, a debt fund will have its specified objective to invest in fixed income instruments or products like bonds, government securities, debentures, etc. Similarly, an equity fund will invest in stocks and other equity instruments.

What is the benefit of investing in mutual funds?

One of the key advantages of investing in a mutual fund is that each investor (even with a small investment) gets access to professional money management and expertise. Also, it would be very difficult for an investor to create a diversified portfolio of investments on his own with a small amount of money. With mutual funds, each investor participates proportionally in the return the scheme generates.

Each unit gets a proportional share of gain (or bears loss) from the fund. There is a portfolio report generated for each investor, which tracks all investments and the returns generated by the mutual fund.

Requirements for investments in Mutual Funds

One Needs to be KYC compliant with one of the KRAs to be able to invest in Mutual Funds. You can get KYC compliant online or offline depending on your comfort. You need following documents to get KYC compliant:-

- PAN Card

- Bank Proof

- Address Proof

We also assist you with completion of your KYC process.

What is SIP?

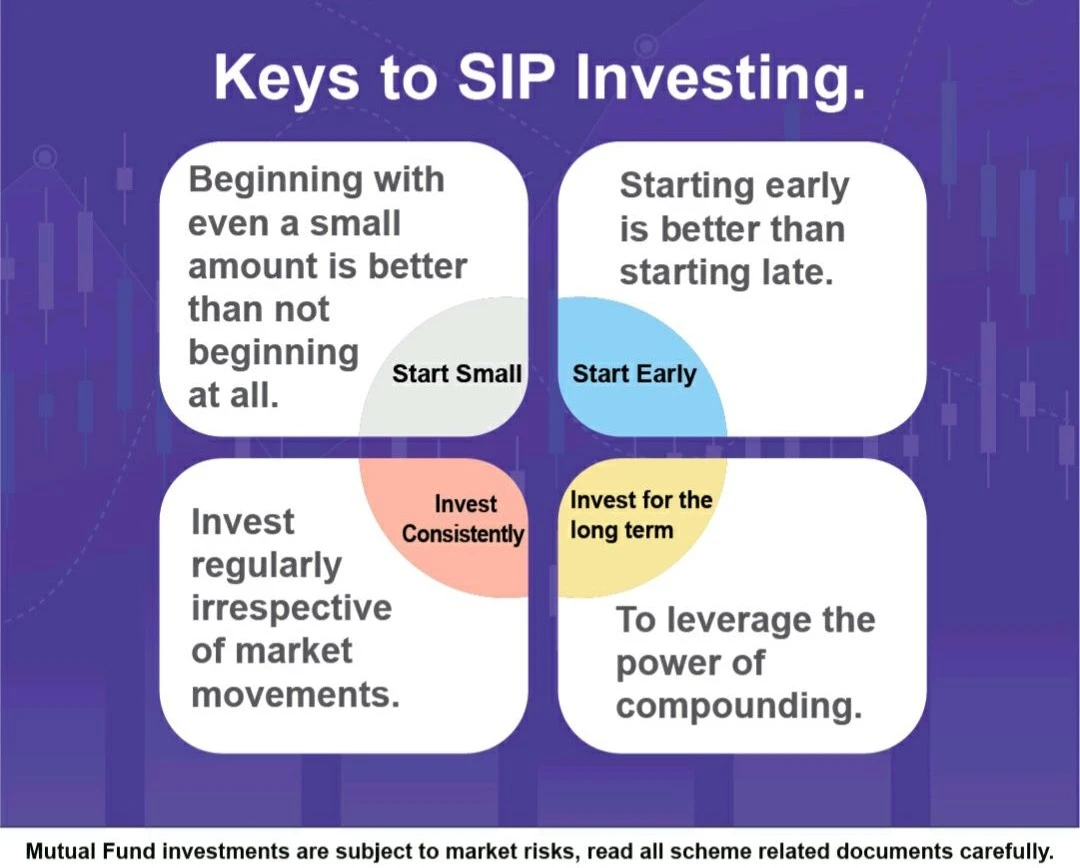

They say, "the journey of 1000 miles begins with a single step". Systematic Investment Plans (SIP) work on the same philosophy. An SIP is a simple, convenient, and disciplined way to meet your financial goals. It is designed to help investors to save regularly & accumulate wealth through the power of compounding & rupee cost averaging in a disciplined manner over a long period.

Three important principles of SIP

- Start early

- Invest regularly

- Invest the right amount

What is SWP?

A Systematic Withdrawal Plan (SWP) is a service offered by mutual funds or other investment platforms that allows investors to withdraw a fixed amount of money at regular intervals from their investment. It's commonly used by retirees or others who need a steady income stream from their investments & often called as worlds best pension plan.

Ready to get started?

If you have any query regarding any services then fill the contact form or contact us.

Contact Us