Financial Planning

Logical process of managing your money in a way that can help you to achieve all your financial goals with ease and also protect you from uncertainty and contingency.

Benefits

- Helps in reducing financial uncertainty

- Protects you from financial contingencies

- Reduces stress and anxiety

- Helps you to set financial goals

- Increases the chances of attaining goals

Financial planning steps to build wealth in long term

Step 1

Learn the rules of investment

- Invest Early

- Invest Regularly

- Invest for long term

- Invest with financial goal

- Considering real return and taxation

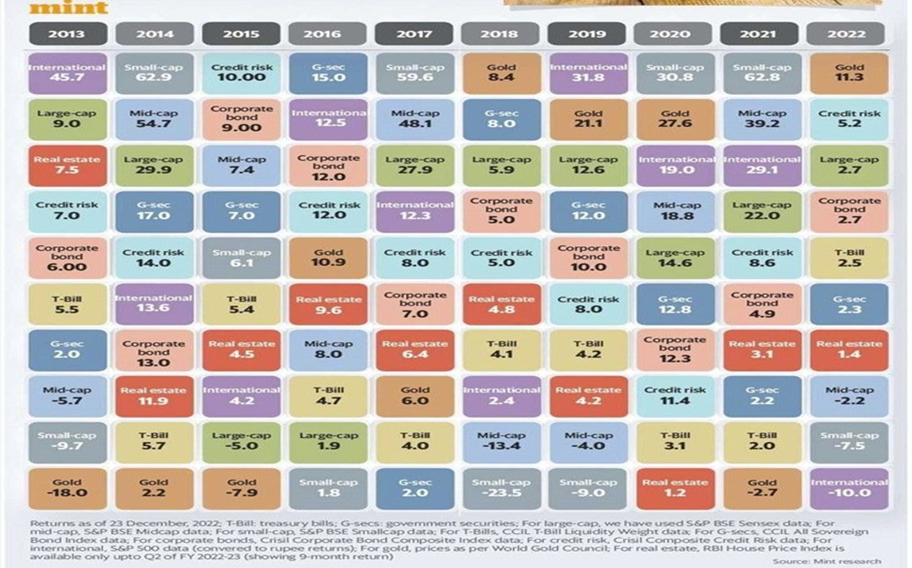

- Follow asset allocation

- Don’t time the market

- Manage cash flow

Step 2

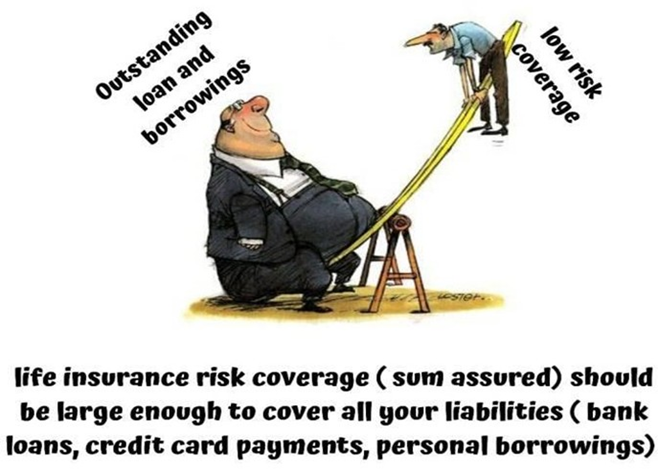

Why life Insurance???

“A man who dies without adequate life insurance should have to come back and see the mess he created.” – WILL ROGERS

Insure Yourself adequately

Step 3

Contingency Planning

- The loss of regular income cripples your personal finance

- Contingency can arise due to any non-predictable reason like, job loss business loss, economic recession, pandemic etc.

Why to plan for Contingency

- Contingency can arise anytime

- Planning for contingency can help you to protect your long-term investments

- Provides the cash flow when the income stops due to contingency

- Any unplanned expenses can be managed

Emergency fund should be build by investing into avenues into high liquidity & low risk investment avenues like liquid MF schemes.

Step 4

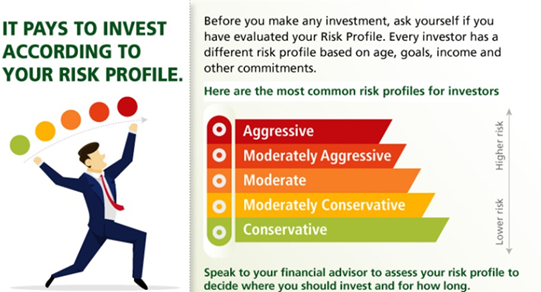

Evaluate your Risk Profile

Step 5

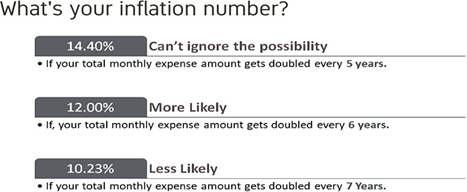

How to keep your money safe?

To save the value of money, you need to earn at-least the return (Post tax) equal to YOUR PERSONAL INFLATION.

Step 6

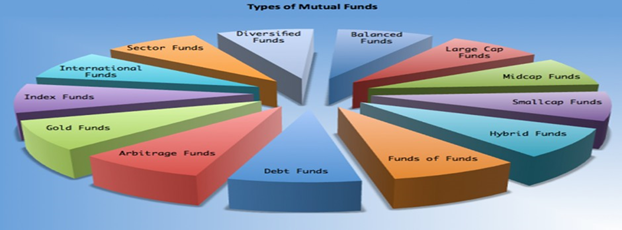

Invest with right asset class with different Types of Mutual Fund

Debt Funds

- Money Market Funds

This category of funds invests in upto 1 year duration segment and investors can invest their short-term surpluses in this category as it generally has lower volatility and can provide better after-tax returns compared to other short term saving instruments such as bank savings account. These types of funds include liquid fund, ultra short term fund, low duration fund and money market fund.

- Short Term Funds

This category of funds generally invests in 1 – 4 years duration segment. Short term funds can address the medium-term investment needs of an investor. These types of funds include banking PSU funds, corporate bond funds and short duration funds.

- Dynamic Bond Funds

This category of funds can invest across the curve. Dynamic bond funds will endeavor to capture interest rate cycles and can be used as a long term investment vehicle by investors.

Types of Equity Funds

- Large Cap Funds

These funds invest in the stocks of the largest 100 companies by market capitalization in the Indian Stock Market. Larger stocks are expected to be less risky.

- Mid Cap Funds

These funds invest in stocks of mid cap category companies, ranked between 100 to 250 by market capitalization. Larger stocks are expected to be less risky whereas smaller stocks may have higher potential to grow.

- Small Cap Funds

These mutual funds select stocks for investment from the small cap category, which includes all stocks except the largest 250 stocks by market capitalization.

- Multicap Funds

Multi-cap funds are open-ended and diversified equity mutual funds that invest in stocks of companies across all market caps in varying economic sectors and industries. (Minimum 25% in large caps, Mid-caps & small caps). Multi-caps can invest up to 75 per cent in equity. These funds normally follow aggressive investment strategies.

- Flexi cap Funds

Flexi-cap funds invest in stocks of all the large-cap, mid-cap, and small-cap companies in a bid to deliver stellar returns to investors. However, flexi-caps can invest up to 65 percent of their total corpus in equities and equity-related instruments. These funds normally follow conservative investment strategies.

- Contra Funds & Value Funds

Contra funds invest in underperforming stocks while value funds invest in undervalued stocks. But both contra funds and value funds are high-risk, long-term investments that require thorough analysis, research and patience.

- Balanced Advantage Fund

These mutual funds invest in both Stocks and Debt/Bonds. They are process-driven funds that shift between equity and debt, depending on market conditions and aim to provide equity-like returns, but with lower uncertainty.

- Thematic Funds

These funds invest in stocks selected from a single sector or fit in specific themes like banking, Pharma, Infrastructure, etc.

- Equity Linked Saving Schemes (ELSS)

These mutual funds maintain portfolios largely in the stocks. However, you cannot sell these units for 3 years from purchase date. You can save taxes by showing investment as a deduction under 80c.

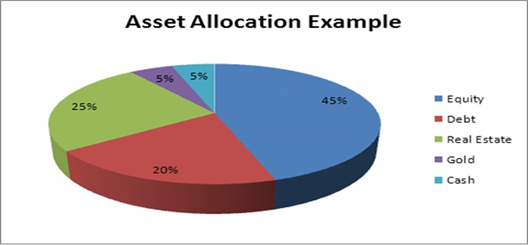

- Multi-Asset Fund

These mutual funds invest in at least 3 asset classes with at least 10% in each asset class. These funds typically have a combination of equity, debt, and one more asset class like gold, real estate, etc.

- Index Funds

These mutual funds create a portfolio which mimics a given index. So, these funds are expected to give similar returns as per index. Index funds can be bought and sold only for the price set at the end of the trading day. This is a kind of passive fund.

- Exchange Traded Funds (ETF’s)

ETFs are funds that trade on exchanges, generally tracking a specific index. ETFs can be traded throughout the day like stocks. This is a kind of passive fund. Demat account is required to transact in ETF funds.

Step 7

SIP = Systematic Investment Plan for Wealth Creation

| S | Systematic | Save | Sapna | Sleep |

| I | Investment | Invest | In | In |

| P | Plan | Progress | Progress | Peace |

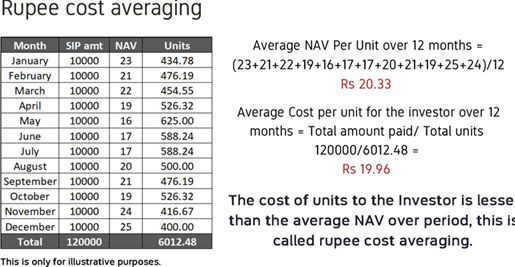

Systematic Investment Plan (SIP) is a tool that allows you to invest in mutual funds through small, periodic installments.

SIPs help you set aside a fixed amount every month for investments thus contributing towards your goals. For investment purposes, we often wait to collect a large amount of money and invest it all at once. Through SIP you can start with a smaller amount on a monthly basis and create wealth over the long term.

How SIP Works?

STP – Systematic transfer Plan

It is the transfer of funds from one mutual fund scheme to another at regular intervals. Like you invest a lumpsum amount in debt & transfer funds to your selected equity scheme on daily, weekly, or monthly basis. You earn interest constantly even while you transfer money from debt-to-equity funds and also simultaneously averaging your purchase price of equity investment with market volatility

Step 8

SWP – Systematic Withdrawal Plan

A systematic Withdrawal Plan (SWP) is a facility in which an investor can withdraw a predetermined amount at pre-decided intervals from his/ her investments in selected mutual fund schemes.

SWP in mutual funds helps in creating a regular source of income for retirees or supplementary income for those with specific needs –like meeting child’s education, regular cash flows to elderly parents etc.

Step 9

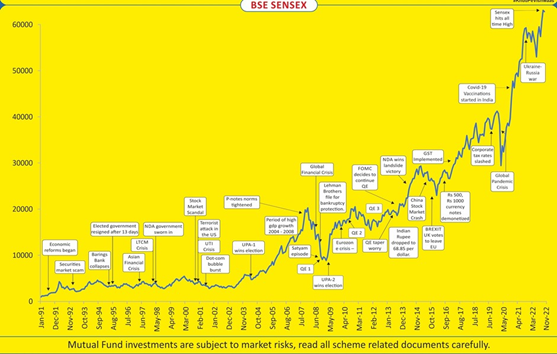

Invest for long term & remain invested in the market for long term

Step 10

Asset Allocation in equity-debt as per your risk profile

Step 11

How to set smart goals?

Answer the following questions

- For what will you need money?

- When will you need money?

- How much money will you need?

- Can I achieve it with reasonable assumptions?

Step 12

Market Timing & Volatility

Your behavior is most important in Personal Financial Planning.

Other things in your investment journey like; financial planning, equity investment, returns, your financial planner etc. comes next.

investing is simple but not easy & is very boring

your emotions towards your investments makes it difficult to create wealth

always be careful about your behavior in the investment journey that will decide how much wealth you will create from your investments……

let’s plan

long-term thinking & planning enhances short term decision making. Make sure you have a plan of your life in your hand, and that includes the financial plan and your mission.

Disclaimer: This article is purely for general information purposes and is not intended to constitute a recommendation, offer or advice and shall not be acted upon as a professional advice. The views expressed are the personal views of the author. Nothing constitutes a solicitation to anyone to act based on opinions expressed in this presentation. The information is subject to change without prior notice. Before making any decision, you should consider whether the information is appropriate considering your needs and you may wish to consult a professional adviser for further advice. In no event, shall the author be liable for any direct, indirect, or incidental damage arising in connection with the use of information herein contained. Mutual fund investments are subject to market risks, read all scheme related documents carefully.